What exactly is the super-deduction?

The super-deduction is a temporary 130 percent first-year capital allowance for qualifying plant and machinery assets, accompanied by a 50 percent first-year allowance for qualifying special rate assets.

From April 1, 2021, to March 31, 2023, this super-deduction allows companies to deduct their tax bill by up to 25 percent with every euro invested—proving the UK capital allowance regime to be amongst the most competitive worldwide. In addition to saving money, this tax break encourages firms to invest in productivity-enhancing plant and machinery assets, which in return will help them grow and make further investments. It is important to note, the super-deduction does not apply to partnerships or individuals—you must be a company to qualify.

The intended purpose of this tax break is to support business investment, boost company recovery following the COVID-19 pandemic and improve the UK’s total productivity.

According to the Treasury’s super-deduction fact sheet, “Making capital allowances more generous works to stimulate business investment. As a result, these measures can promote economic growth and counter business cycles. The super-deduction will give companies a strong incentive to make additional investments, and to bring planned investments forward.”

What are capital allowances?

Capital allowances allow taxpayers to write off the cost of certain assets against their taxable income. These take the place of accounting depreciation, which is normally not tax-deductible. Each year, businesses deduct their capital allowances when figuring their taxable profits.

In converting accounting profits into taxable profits, a business is typically required to “add back” any depreciation--but with super-deduction, they can deduct capital allowances.

The 130 percent super-deduction and 50 percent first-year allowance are both generous, temporary capital allowances for investments in plant and machinery. Each will enable investing companies to lower their corporation tax bills.

What qualifies as plant and machinery assets?

Most tangible capital assets used within a business are considered plant and machinery when it comes to capital allowances. The assets listed may qualify for either the super-deduction or the 50% FYA, but are not limited to:

Solar panels

Computer equipment and servers

Tractors, lorries, vans

Ladders, drills, cranes

Office chairs and desks,

Electric vehicle charge points

Refrigeration units

Compressors

Foundry equipment

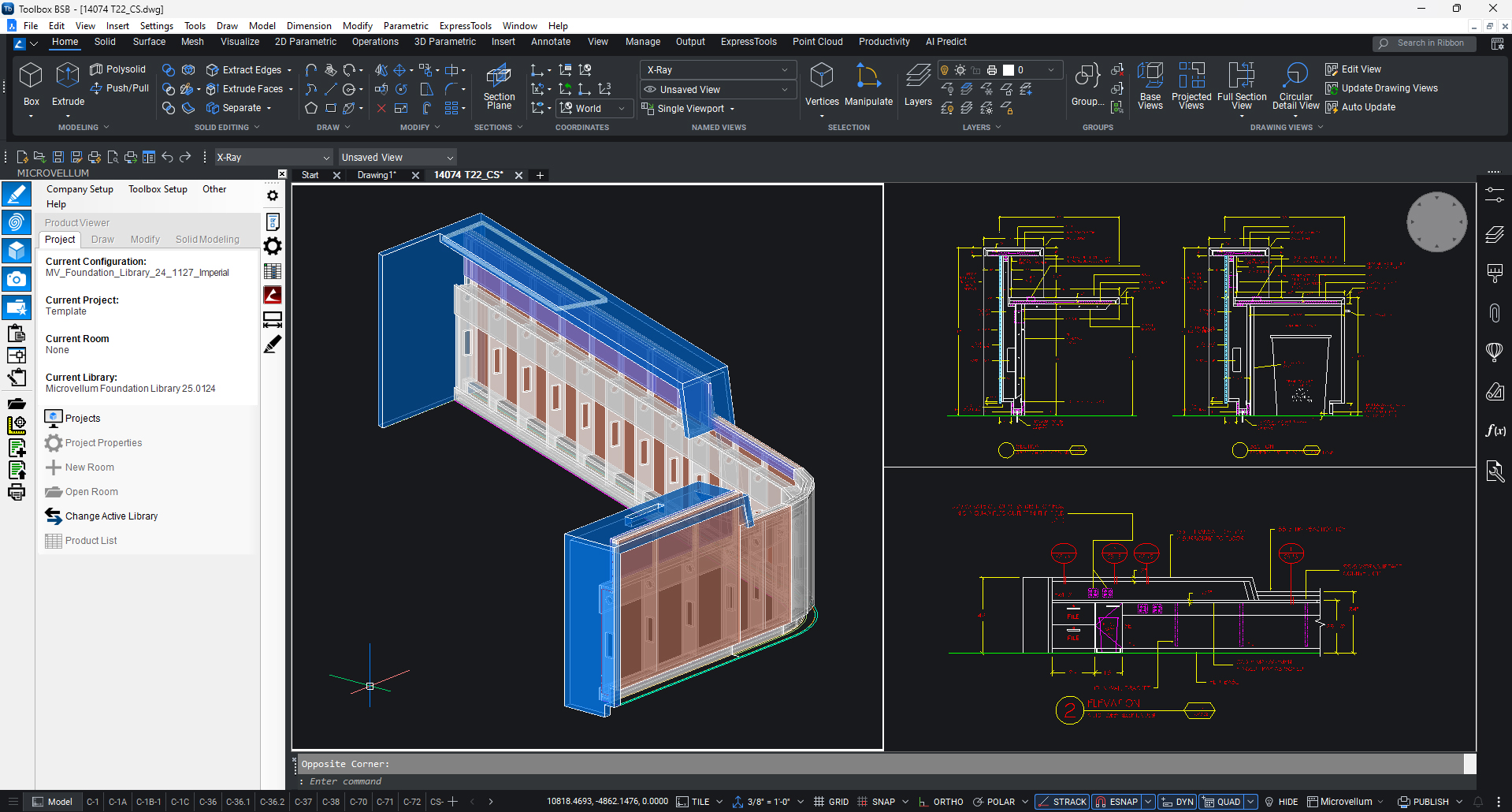

Does this include Microvellum Software?

Yes—Microvellum Software qualifies for the super-deduction.

Please visit the Super-deduction - GOV.UK (www.gov.uk) page to learn what this tax break could mean for your company.